Have you ever bought something or said yes to a so-called “deal” only to feel suckered later when you read – or were made aware of – the fine print involved?

If you want to avoid getting burned, and especially if you want to maintain a great credit rating, you absolutely must abide by one written rule concerning credit that is of utmost importance.

What’s this rule? It’s simply this: the fine print counts too.

In fact, the fine print often counts more than the “headlines” or promised benefits of any deal you encounter.

How do banks, credit-card companies, retail creditors, and others tell you that the fine print counts? It’s when they make statements like these:

- Terms and conditions

- Certain restrictions apply.

- Consult rules for further information.

- Complete details listed below

- Full terms, rates, fees, and other costs on back

- Limitations and exclusions

- Please see application for all details.

- Pricing and terms

- Consult disclosures for important information.

- *

Did you note that the last item above was just an asterisk? When you see that asterisk, pay as close attention as you would if you saw “Terms and conditions” because that’s exactly what it means. The asterisk indicates that there is some fine print you have to find elsewhere to learn all the details involved.

So now you’ve been warned: If you ever see language like the statements listed above, that’s your cue to read the fine print for any product, service, or deal you’re contemplating. In many cases, if you take the time to read the fine print, all sorts of red flags will pop up, telling you to slow down and fully understand what you’re about to do.

All Credit-Related Offers Contain the Hook and Fine Print

Oh, if I had a dollar for every time I’ve heard people complain (myself included) about some aspect of their credit and debt that was tied to fine print.

Here’s what happens in many of these cases. We get so wowed by a marketing message or deal that before we know it we’re caught up in a transaction concerning which we don’t understand the fine print. Or, worse, we don’t even bother to read it.

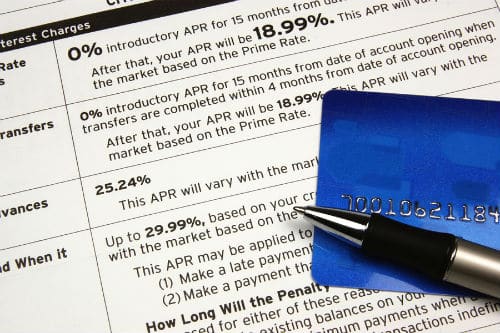

Perhaps we ignore the fine print because we think that only the bold-faced marketing message counts, especially when it seems to work in our favor, such as the balance-transfer promotion for a new credit card that indicates “0% for balance transfers.”

After you read the fine print of this seemingly attractive offer, however, you find out that the balance-transfer fees are exorbitant or that the interest rate on standard purchases is sky-high. You know what I’m talking about, right?

I’ll share a few stories from my own life and some other examples to explain why you absolutely must not forget that the fine print counts. After all, the institutions you deal with aren’t forgetting about the fine print. On the contrary, they’re counting on it to work in their favor.

A 2-For-1 Deal Doesn’t Necessarily Mean 50% Off

Here is a case in point. I fly Continental Airlines regularly. Well, Continental like most air carriers has a credit-card offer, via Chase, that allows you to earn bonus travel miles for your air and hotel purchases as well as other expenditures.

What initially caught my eye, however, was one specific perk: you could get 2-for-1 First Class/Business tickets when you fly internationally and use this Continental-branded credit card to buy the airfare.

Immediately I had visions of soaring across the Atlantic Ocean and trotting off to Europe in style and comfort with my husband—all for half price.

At first I thought, “Wow! That’s like getting 50% off! What a great deal! All I have to do is to buy one first-class ticket (Continental calls its service BusinessFirst), and then my hubby travels free. Whoopee! What a no-brainer for travel buffs like us!” Then I settled down and decided to read the fine print.

One key detail in the fine print of that offer made the whole deal far less enticing. Yes, you could in fact get 2-for-1 BusinessFirst tickets anytime you booked international airfare using the credit card, but there was a special requirement.

Some might call it a “catch.” However, I’ll be fair to Continental and simply call it a “requirement” because the airline did exactly what it was supposed to do and disclosed the requirement right there in black and white. In the fine print, yes, but it was there nonetheless.

Here’s what the requirement stipulated: to get those 2-for-1 BusinessFirst tickets you must purchase a special type of BusinessFirst ticket, namely one full-fare ticket. If you’ve ever flown to Europe or any place else internationally and paid for a full-fare First Class/Business ticket (I, for one, have not), you know that the average cost for such a round-trip ticket can be very pricey.

For instance, when my husband and I flew BusinessFirst to Stockholm, Sweden, in August 2009, we traveled in Continental’s first-class cabin. However, the tickets we purchased, at a cost of about $2,000 apiece, were “discounted” BusinessFirst tickets as opposed to “full-fare” tickets. At full fare first-class tickets would have been about $8,800 each.

So much for what I thought would be a killer 2-for-1 travel deal. In reality I wouldn’t be getting a “half-off” deal, as I wrongly assumed by honing in on the “2-for-1” marketing message.

Most “2-for-1” offers of this type don’t “save” money at all because of the high cost of that initial First Class/Business ticket. Nevertheless, due to other attractive features, I still considered the Continental offer – and in 2011 I did ultimately apply for and get approved for the card of my choice.

And I’m a person who weighs very carefully when and under what circumstances I apply for credit. So at least I went into the transaction with my eyes wide open. And, again, I can’t honestly fault Continental. They disclosed what I’d have to do—right there in the fine print of the credit-card offer.

The Importance of Reading the Fine Print

It’s been said that “The big print giveth, and the little print taketh away.” In many ways that’s true. Here’s why the fine print counts, often more than the bold-faced advertising or marketing message you may have seen in an offer.

• The fine print is where you’ll learn what you must do to qualify for something.

• The fine print is where you’ll find out when the benefits promised apply, when they don’t, and when they can change, expire, or be revoked.

• The fine print is where you will discover all the restrictions, exclusions, and other rules that govern a deal.

Therefore you must always think about any loan, credit offer, agreement, or special deal as having two parts: the hook and the fine print.

The hook is designed to do just that—“hook” you into saying “Yes.” The hook is the bold-faced advertisement or marketing message that grabs your attention.

It will be something enticing such as “No Money Down,” “Low 4.9% APR,” “Only $9.95,” “Cash Back Bonus,” or “Free.”

The fine print invariably has less appealing language. It covers the nitty-gritty details of the offer, including its limitations, pricing, fees, terms, and conditions.

The fine print is most often located at the end of an offer or agreement. In the case of online offers, the fine print is typically one or more click away from the hook.

While the fine print may be difficult to read, hard to find, and not easy to understand, it is there nonetheless, and it’s your responsibility to read it. If not, you can put your credit standing and your finances at serious risk.