Video: Does Your Spouse Spend Too Much Money on Get Rich Quick Schemes?

Is your spouse constantly falling for the latest “get rich quick” scheme?

From stacks of multi-level marketing brochures to shelves full of unsold products, does your home feel more like a warehouse of failed business ideas than a place of peace?

If you’re nodding in agreement, you’re not alone—and you’re likely watching your finances spiral in the process.

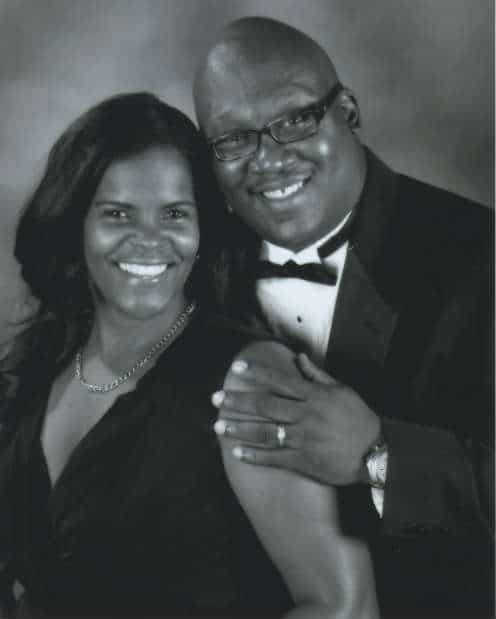

In this video, financial expert Lynnette Khalfani-Cox offers straightforward advice on how to handle a spouse who’s addicted to high-risk money ventures that promise wealth overnight but often deliver little to no return.

When Does Entrepreneurial Drive Cross the Line?

There’s nothing wrong with ambition. But when one partner repeatedly invests in speculative ventures without proper planning or realistic expectations, it can become destructive—not just to your bank account, but to your marriage too.

Get rich quick schemes are particularly dangerous because they often:

-

Drain family savings

-

Encourage secretive financial behavior

-

Fuel false hope and repeated disappointment

-

Create mounting debt and stress

Signs Your Spouse Might Be Hooked on MLMs or Schemes

-

Frequently buys into “business opportunities” with high upfront costs

-

Regularly attends webinars, seminars, or “launch events”

-

Has no clear business plan or measurable progress

-

Dismisses your financial concerns or advice

-

Hides receipts or downplays the money being spent

Setting Boundaries and Compromising Wisely

In the video, Lynnette shares practical tips for protecting your finances while keeping your relationship intact. Here’s what she recommends:

-

Open the Lines of Communication: Address your concerns with empathy, not criticism. Let your partner explain their motivations.

-

Set a Financial Limit: Agree on a cap for discretionary spending on business ventures or side hustles.

-

Request Accountability: Ask for updates or measurable goals before any new investment is made.

-

Create a Joint Financial Plan: Revisit your household budget and savings goals together to refocus your priorities.

-

Seek Professional Help: If disagreements persist, consider working with a certified financial counselor or coach.

Get Personalized Coaching with Lynnette

If this situation hits close to home, you’re not stuck. Lynnette offers one-on-one financial coaching to help couples align on money goals, break the cycle of poor investments, and rebuild financial trust.

Book your personalized session and take the first step toward financial peace—together.

FAQs: Spouse Spending on Get Rich Quick Schemes

How do I stop my spouse from spending on MLMs?

Start with a candid, non-judgmental conversation. Set boundaries, agree on a spending cap, and ask them to show a clear ROI plan for any new ventures.

Is investing in MLMs always a bad idea?

Not necessarily, but most people don’t turn a real profit. If the model relies more on recruiting than selling a product, it’s likely a pyramid scheme.

Can financial coaching help couples with money disagreements?

Yes. A neutral third party like a financial coach can help both partners identify shared goals, rebuild trust, and develop a sustainable money plan.

What are alternatives to risky money schemes?

Consider proven ways to build wealth like budgeting, investing in index funds, real estate, or launching a well-researched side business with a real market need.

Get one-on-one financial coaching from Lynnette.