Will Social Security Be Bankrupt Before You Retire

Will Social Security Be Bankrupt Before You Retire? What You Need to Know Social Security is a vital program that provides financial support to millions

Planning for your retirement can be an exciting endeavor, but also a scary prospect if you feel financially unprepared.

So how do you know if you’re really economically ready to say goodbye to your colleagues and check out of the workforce?

Articles in this category answer many of your questions about retirement planning, saving for retirement and various retirement topics.

You will find additional articles on retirement in my column that I write for AARP.org

Will Social Security Be Bankrupt Before You Retire? What You Need to Know Social Security is a vital program that provides financial support to millions

As individuals approach retirement, the question of housing becomes increasingly significant. Relying on renting for retirement can present several pitfalls that may jeopardize financial stability

Social Security benefits serve as a crucial safety net for millions of Americans, providing financial support during retirement, disability, or in the event of a

Estate planning is a crucial process that involves preparing for the management and distribution of your assets after your passing. It encompasses a variety of

Over 1/4 have side hustles, including retiree side hustle, for ‘a sense of purpose and fulfillment’. Retirees in Utah earn the most from side hustles ($825

10 Basic Steps to Prepare for Retirement: As you embark on the journey toward retirement, it’s essential to take a moment to reflect on what

7 Wise Investment Choices for Retirement to Secure Your Future As you approach retirement, the importance of making informed investment decisions becomes increasingly clear. Retirement

When planning for life after work, annuities for retirement can be one of the most powerful tools in your financial arsenal. These financial products are

When it comes to planning for your retirement, understanding your pension plan is crucial. A pension plan is essentially a financial arrangement that provides you

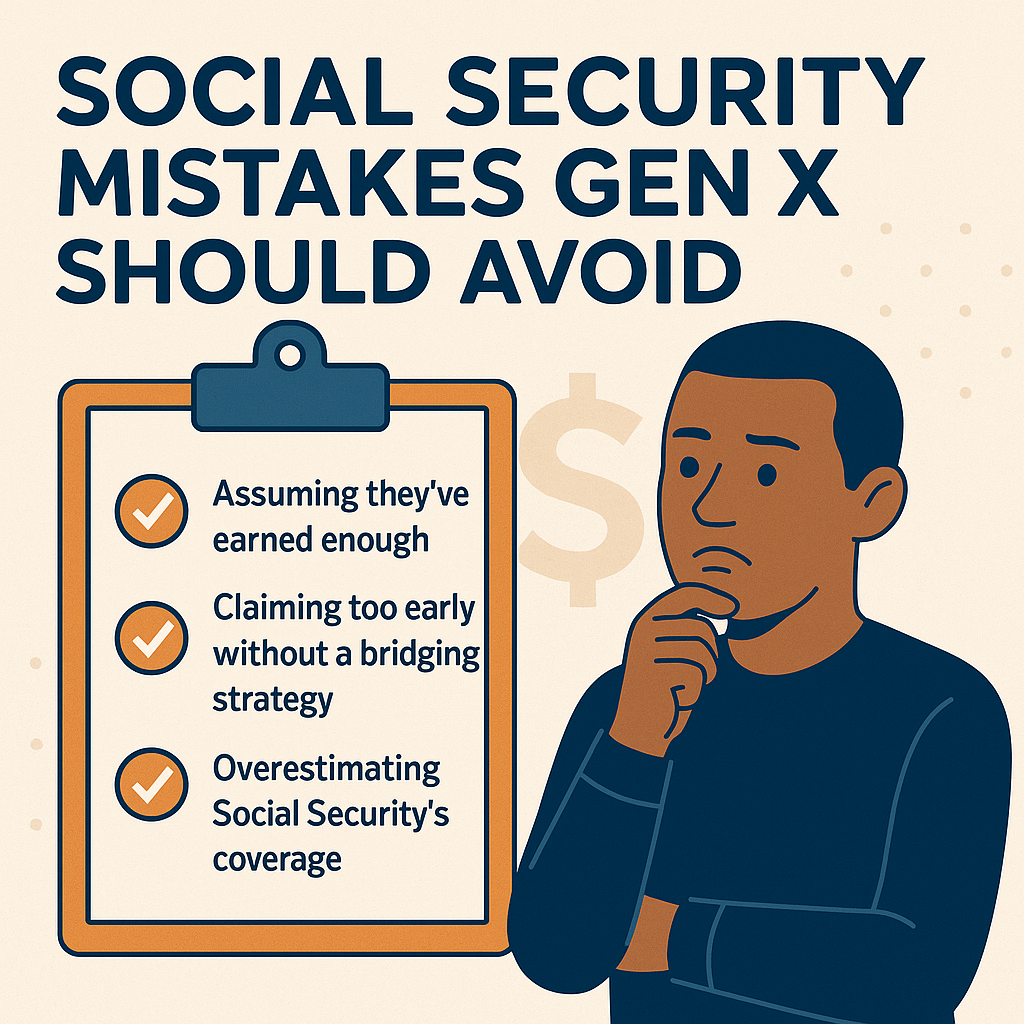

Gen X and Social Security is a topic that’s gaining traction as more Americans born between 1965 and 1980 approach retirement age. According to Charles

Introduction Jubilación — the Spanish word for retirement — evokes joy, fulfillment, and freedom. It’s a stark contrast to the dread and finality that many

The Medicare Savings Program helps low-income individuals pay for Medicare premiums, deductibles, and copayments. Learn how to qualify and apply for financial assistance today.

Healthcare costs in retirement can be a major expense. Learn how to budget for medical costs, explore Medicare coverage, and maximize savings tools like HSAs.

Solo 401k vs SEP IRA: Which is the best self-employed retirement plan in 2025? Compare contribution limits, tax advantages, and flexibility to maximize savings.

Discover effective retirement planning strategies to secure a comfortable future. Learn about key considerations, tips, and expert advice for financial stability.